Top 25 Personal Finance Tricks to Save Money and Grow Wealth: The 2025 Global Playbook

Top 25 Personal Finance Tricks to Save Money and Grow Wealth: The 2025 Global Playbook

Personal finance remains one of the most lucrative and life-changing blog niches for 2025, with exceptionally high CPC keywords targeted by advertisers worldwide. This mega guide offers the latest tricks and actionable tactics for saving money, building wealth, and maximizing financial security—no matter where you live.

Why Personal Finance is the Hottest Blog Niche in 2025

Searches for financial advice and money-saving tips have jumped over 30% year-over-year, and advertisers are spending more than ever on keywords like “life insurance quotes”, “mortgage refinance rates”, “debt relief”, and “investment strategies for beginners”[1][6].

- Personal finance content earns $10–$50+ CPMs and up to $80–$100 CPC for top topics[4][5][6].

- The demand for actionable savings and investment info crosses borders and income brackets.

- Thousands of people search for ways to prepare for recession, inflation, and rising living costs.

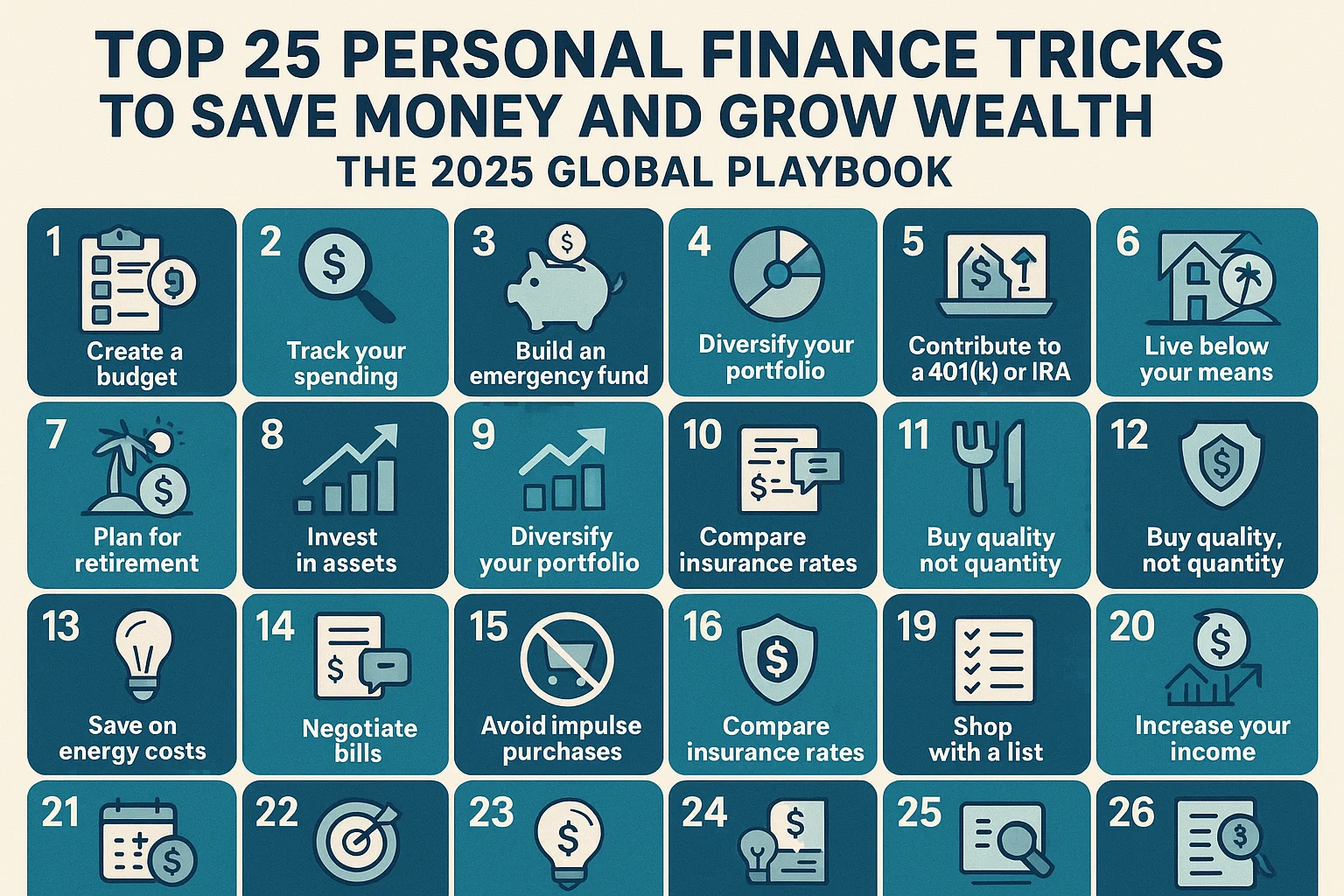

25 Global Money-Saving and Wealth-Building Tips for 2025

These strategies are designed for worldwide audiences—from students and professionals to entrepreneurs and retirees. Each tip is backed by expert insights and recent SEO trends, ensuring you can rank for high-paying keywords and provide maximum value to readers.

- Create a Custom Budget: Use budgeting apps like Mint or YNAB to automate and visualize spending.

- Set Up Emergency Funds: Separate at least 3-6 months of expenses for protection against job loss, health issues, or unexpected events.

- Automate All Savings: Schedule automatic transfers, invest spare change, and use “pay yourself first” principles.

- Maximize Credit Card Rewards: Leverage cashback, points, and intro bonuses for flights, groceries, and bills.

- Refinance Your Mortgage: Secure lower rates by shopping around and using comparison portals, a top CPC keyword in finance[1][5].

- Negotiate Bills Annually: Renegotiate internet, mobile, insurance, and streaming services.

- Pick High-Yield Savings Accounts: Move funds into accounts with the best interest rates and lowest fees.

- Slash Subscriptions: Audit unnecessary TV, music, software, and fitness memberships.

- Start Investing Early: Compound interest rewards those who invest in mutual funds, index ETFs, or real estate.

- Use Long-Tail Investment Strategies: Target “passive income”, “crypto investing for beginners,” and “financial independence” keywords[6].

- Track All Expenses: Categorize and review each expense monthly to spot savings opportunities.

- Embrace Minimalism: Prioritize value over volume in all purchases; avoid impulse shopping.

- Plan Your Retirement: Use online calculators and guidance for “retirement planning 2025”, an evergreen high CPC topic[6].

- Eliminate High-Interest Debt: Pay off credit cards first, then tackle personal loans and student debt.

- Join Community Investment Groups: Pool resources for property, business startups, or stocks.

- Take Advantage of Tax-Advantaged Accounts: Consider IRAs, 401(k)s, HSAs, and similar plans for savings and tax deductions.

- Utilize Money Management Apps: Digital trackers provide real-time analytics for smarter financial decisions.

- Invest in Crypto Safely: Learn from trusted platforms; avoid FOMO and prioritize security.

- Generate Passive Income Streams: Consider dropshipping, affiliate marketing, rental properties, or dividend stocks.

- Learn High-Income Skills: Coding, data analysis, copywriting, and design offer strong pay and freelance options.

- Get Insurance for Everything Important: Life, health, property, and travel insurance safeguard assets and loved ones.

- Shop with Coupons and Discounts: Browser extensions like Honey or CashbackWorld automatically apply savings.

- Switch to Remote Work Tools: Freelancing and remote jobs let you cut commutes, lunches, and work-related expenses.

- Build Strong Financial Habits: Schedule reviews, automatic payments, and regular check-ins for ongoing success.

- Upgrade Financial Literacy Continuously: Take online courses and join webinars to stay ahead of trends.

How to Rank for High CPC Personal Finance Keywords

Monetization depends on smart keyword optimization and strategic blog structure. Here are the highest-value search terms and tactics for 2025[1][4][5][6]:

- “Life insurance quotes online”

- “Mortgage refinance rates”

- “Debt relief for freelancers”

- “Passive income strategies”

- “Tax planning for small businesses”

- “Retirement investment calculators”

- “Crypto investing for beginners”

- “Financial planning for millennials”

- “Personal finance for women entrepreneurs”

- “Budgeting for students”

To boost CPM, focus your content on these topics, provide clear answers, and use tables, lists, and FAQs to increase engagement[7][9].

Case Study: Passive Income Strategy in 2025

A blogger launched a guide targeting “best passive income ideas for 2025.” By including affiliate links for investing platforms and financial tools, the blog ranked for high CPC keywords and generated $35 CPM via Mediavine ad network[9]. Key takeaways included:

- Long-form, actionable content outperformed shorter articles.

- Email list building and SEO optimization increased repeat visits and ad value.

- Branded webinars and downloadable guides expanded reader trust and lead generation.

Frequently Asked Questions (FAQs)

Q1: How can I save more money on everyday expenses?

Routine expense tracking and annual bill negotiations can save hundreds of dollars every year. Online tools make this process quick and painless.

Q2: What’s the biggest mistake in personal finance?

Ignoring high-interest debt is the fastest way to lose money. Always pay off credit cards first, then focus on long-term savings and investments.

Q3: Are money saving blogs profitable?

Absolutely—money saving and personal finance blogs attract high-paying advertisers, affiliates, and sponsored partnerships[1][4][9].

Conclusion

Whether you are starting fresh or refining your financial game, 2025 is the perfect year to leverage global opportunities in personal finance. Use these proven tricks and SEO insights to maximize blog monetization, build long-term wealth, and save money smartly every month. Take control of your financial destiny today.

Comments (3)