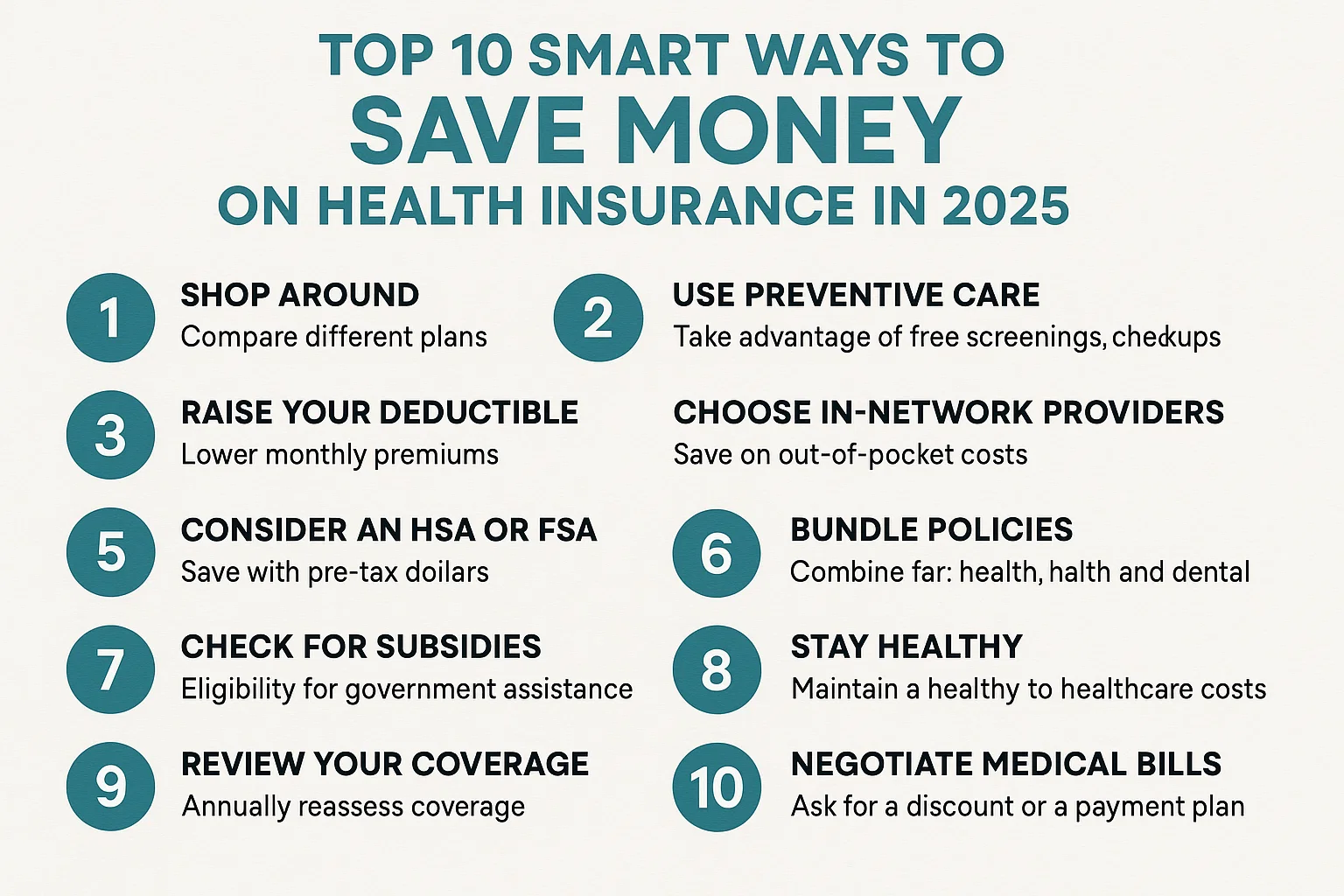

Top 10 Smart Ways to Save Money on Health Insurance in 2025

Top 10 Smart Ways to Save Money on Health Insurance in 2025

Health insurance is no longer a luxury—it is a necessity. With rising medical costs, unpredictable illnesses, and global health concerns, having the right health insurance plan provides peace of mind and financial security. However, the challenge many individuals and families face is the ever-increasing cost of premiums, deductibles, and out-of-pocket expenses. The good news? There are numerous strategies you can use to save money on health insurance in 2025 without sacrificing quality coverage.

1. Compare Multiple Health Insurance Plans

One of the most common mistakes people make is sticking to the first insurance plan they find or blindly renewing their existing one every year. In 2025, with global competition among insurance providers, comparing multiple plans has never been easier. Use online comparison platforms, brokers, and government marketplaces to evaluate coverage, costs, and additional perks.

Tips:

- Check not only the premium but also co-pays, deductibles, and maximum out-of-pocket limits.

- Look for hidden benefits such as free preventive care, telehealth services, or wellness incentives.

- Read customer reviews and ratings for claims settlement efficiency.

2. Opt for High-Deductible Health Plans (HDHPs) with HSAs

If you are generally healthy and don’t expect frequent medical visits, a high-deductible health plan (HDHP) combined with a Health Savings Account (HSA) can be a game-changer. These plans usually have lower premiums, and the HSA lets you save pre-tax dollars to cover eligible medical expenses. In 2025, many countries are expanding tax-advantaged savings programs for healthcare, making this strategy even more attractive.

3. Take Advantage of Preventive Care Benefits

Most modern health insurance plans cover preventive services at no additional cost. These include annual checkups, vaccinations, cancer screenings, and more. By utilizing these services, you can detect health issues early and avoid expensive treatments later. Prevention is not just about health—it’s about smart financial planning.

4. Use Telemedicine and Virtual Care

Telemedicine has revolutionized the healthcare industry, especially post-pandemic. Many insurance providers in 2025 now offer free or low-cost telehealth consultations. This reduces the cost of visiting doctors in person, cuts transportation costs, and saves time. For non-emergency medical concerns, telemedicine can save you hundreds of dollars annually.

5. Negotiate Your Medical Bills

Few people realize that medical bills are negotiable. Hospitals and clinics often charge higher rates for uninsured or underinsured patients. By negotiating or requesting itemized bills, you can identify unnecessary charges and reduce your overall costs. In some cases, providers offer discounts for upfront payments or installment options with zero interest.

6. Stay Within Your Insurance Network

One of the fastest ways to overspend on healthcare is by going out-of-network. Insurance companies have preferred providers, and using them ensures lower co-pays and negotiated rates. Before scheduling appointments or procedures, confirm that the provider is in-network to avoid surprise bills.

7. Leverage Employer-Sponsored Health Insurance

If your employer offers health insurance, take full advantage of it. Employers often cover a significant portion of the premium, making it more cost-effective than individual plans. In 2025, many companies are also offering additional perks such as gym memberships, wellness stipends, and free annual health checkups to encourage employee health and reduce claims.

8. Quit Smoking and Improve Your Lifestyle

Your health habits directly influence your insurance premiums. Smokers, heavy drinkers, and individuals with poor lifestyle choices often pay much higher premiums. By quitting smoking, reducing alcohol intake, maintaining a healthy diet, and exercising regularly, you can save significantly on premiums while improving your overall health.

9. Bundle Insurance Policies

Just like bundling home and auto insurance, some providers allow you to bundle health insurance with dental, vision, or even life insurance. This can result in discounts and additional perks. Explore whether your provider offers multi-policy discounts in 2025.

10. Regularly Review and Update Your Plan

Life circumstances change—marriage, children, career shifts, or moving abroad can all impact your health insurance needs. Review your policy annually to ensure it still aligns with your needs. By adjusting your coverage, you can avoid overpaying for unnecessary benefits or being underinsured.

Extra Global Money-Saving Tips for 2025

- Use Wellness Apps: Many insurance providers offer discounts if you use fitness trackers or wellness apps that monitor physical activity.

- Look for Government Subsidies: Some countries provide subsidies for low-income families or senior citizens.

- Enroll During Open Enrollment: Missing the enrollment window could lock you into a more expensive plan.

- Check for Family Floater Plans: Instead of buying individual policies, family floater plans can provide better coverage at a reduced price.

Final Thoughts

Health insurance is an essential part of financial planning in 2025. While premiums and medical costs continue to rise, the strategies outlined above can help you save thousands annually. The key is to stay proactive: compare plans, leverage preventive care, adopt healthier habits, and take advantage of tax-advantaged accounts. Remember, saving money on health insurance is not just about reducing costs—it’s about maximizing value and ensuring long-term financial stability.

By making smarter decisions today, you can secure both your health and financial future.

Comments (3)