Best Health Insurance Plans and Money-Saving Strategies for 2025

Best Health Insurance Plans and Money-Saving Strategies for 2025

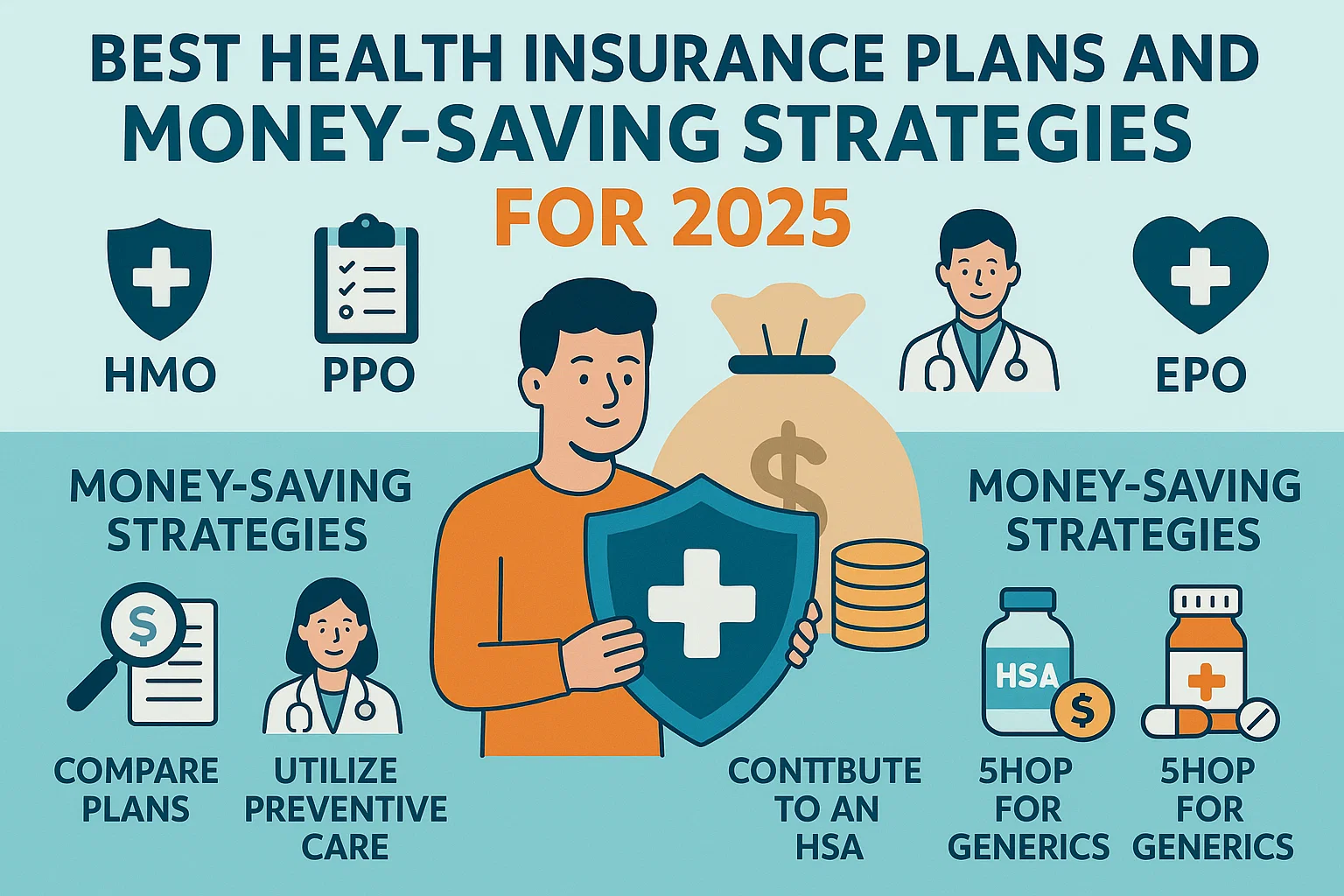

Health insurance is no longer a luxury—it is a necessity. With rising healthcare costs worldwide, people are searching for ways to get affordable health insurance while also saving money on premiums, deductibles, and out-of-pocket expenses. This article is your ultimate 2025 guide to health insurance, tax benefits, and money-saving strategies that can protect your financial health while ensuring you get the medical care you deserve.

Why Health Insurance is More Important Than Ever

Healthcare inflation has been rising globally. According to industry reports, the average healthcare expense for a family in the United States exceeded $12,000 annually in 2024. Countries like India, the UK, and Canada also face challenges such as high waiting times, rising private healthcare fees, and insufficient government subsidies. Without proper insurance, even a small medical emergency can wipe out years of savings.

Top Health Insurance Trends for 2025

- Digital-First Insurance: More insurers are offering app-based claim settlements and cashless networks.

- AI-driven Premium Calculations: Artificial intelligence is being used to assess health risks and create personalized plans.

- Global Coverage: Expats and travelers are opting for global health insurance policies.

- Preventive Care Add-ons: Plans now include wellness programs, gym memberships, and telemedicine benefits.

How to Choose the Right Health Insurance Plan

When comparing plans, you should evaluate:

- Premiums: Monthly or yearly costs you pay for coverage.

- Deductibles: The amount you must pay before insurance starts covering.

- Copayments & Coinsurance: Shared costs with the insurer after deductible.

- Network Hospitals: The hospitals and doctors included in the insurance network.

- Exclusions: Conditions and treatments not covered by the plan.

Money-Saving Tips for Health Insurance

- Compare Multiple Plans: Use comparison tools to find the best coverage at the lowest price.

- Choose Higher Deductibles: If you are young and healthy, selecting a high-deductible plan can reduce premiums.

- Leverage Tax Benefits: In many countries, health insurance premiums are tax-deductible.

- Employer-Sponsored Plans: Always check if your employer offers group health insurance—it’s often cheaper.

- Family Floater Plans: Cover your entire family under one plan to save more.

- Wellness Rewards: Some insurers give discounts for maintaining a healthy lifestyle or regular health checkups.

High CPC Health Insurance Keywords You Should Know

These keywords have some of the highest CPC (Cost Per Click) and eCPM in the insurance niche globally:

- “Best health insurance plans 2025”

- “Affordable family health insurance”

- “Private medical insurance quotes”

- “International health coverage for expats”

- “Health insurance with dental and vision”

- “How to save money on health insurance premiums”

Country-Wise Best Health Insurance Providers in 2025

United States

Some of the leading insurers include UnitedHealthcare, Blue Cross Blue Shield, Aetna, and Kaiser Permanente.

United Kingdom

Bupa, AXA PPP Healthcare, and Aviva are among the best-known private health insurance providers.

India

Popular providers include Star Health Insurance, ICICI Lombard, HDFC ERGO, and Max Bupa.

Canada

Manulife, Sun Life Financial, and Green Shield Canada are top choices.

Australia

Medibank, Bupa Australia, and HCF lead the market with comprehensive coverage options.

Frequently Asked Questions

1. Is health insurance mandatory in 2025?

It depends on your country. In the U.S., mandatory coverage requirements vary by state, while in the UK and India it is not compulsory but highly recommended.

2. Can I buy international health insurance?

Yes, many providers offer global coverage, especially for expats and frequent travelers.

3. How can I save money on premiums?

By increasing deductibles, opting for a family floater plan, or using wellness discounts.

Final Thoughts

Investing in the right health insurance policy is one of the smartest money-saving moves you can make in 2025. Not only does it protect you from unexpected medical costs, but it also offers peace of mind and potential tax benefits. Always compare plans, evaluate your family’s needs, and choose a provider with strong customer support and a wide hospital network. By doing so, you can ensure both your health and your wealth remain secure.

Comments (3)