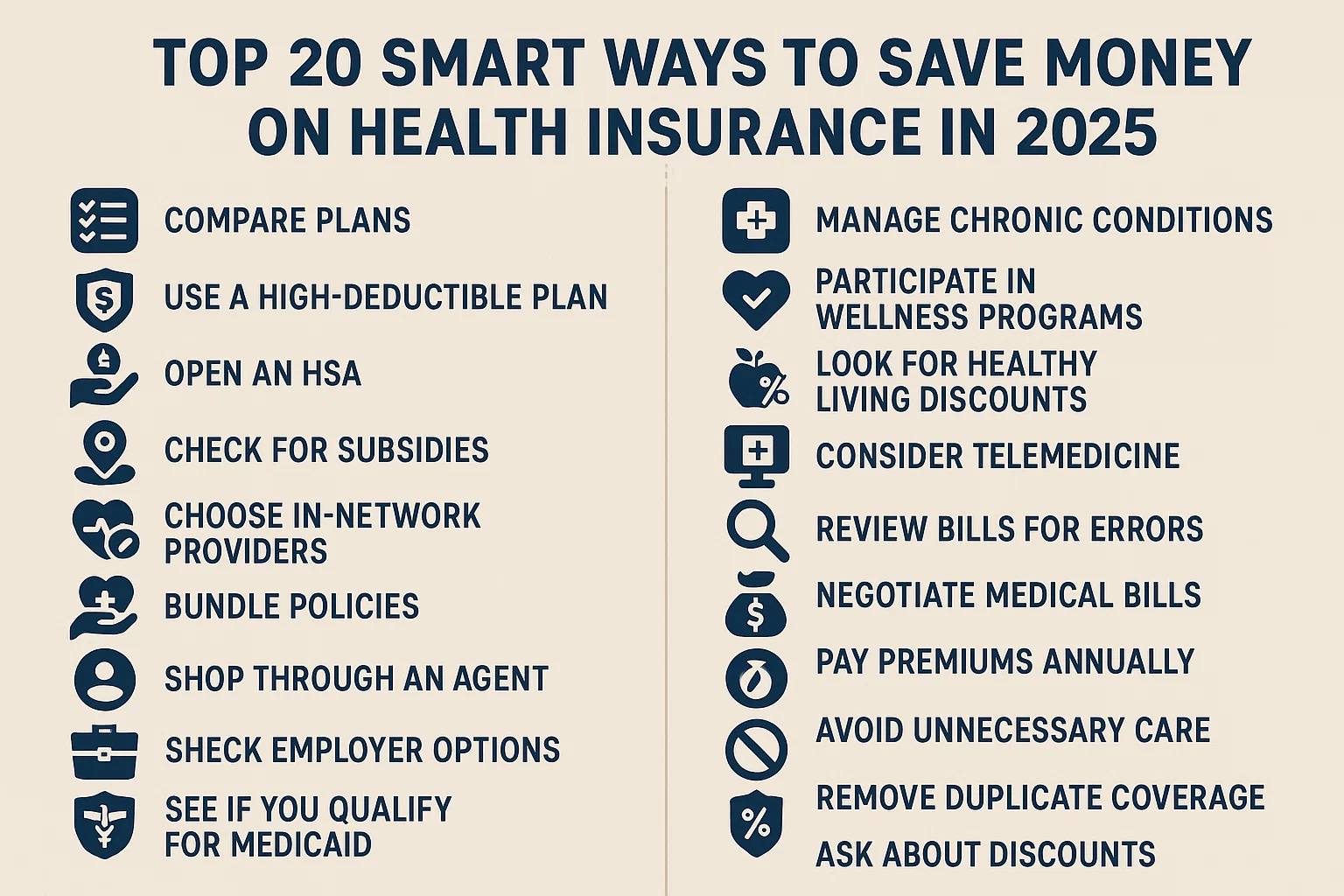

Top 20 Smart Ways to Save Money on Health Insurance in 2025

Top 20 Smart Ways to Save Money on Health Insurance in 2025

Health insurance is one of the biggest expenses in modern life. While it protects us from unexpected medical bills, rising premiums and healthcare costs make it a financial burden for many families and individuals worldwide. The good news is that with the right strategies, you can cut costs without sacrificing quality coverage. In this detailed guide, we will explore 20 powerful ways to save money on health insurance in 2025 and beyond.

1. Compare Health Insurance Plans Regularly

Many people stick with the same insurer for years, but premiums and benefits change every year. By shopping around and using comparison tools, you can find better deals, additional benefits, and lower premiums. Online marketplaces and government exchanges make this process easier.

2. Choose a High-Deductible Health Plan (HDHP)

HDHPs usually come with lower premiums. If you are generally healthy and do not expect frequent medical visits, this can be a smart choice. Pairing an HDHP with a Health Savings Account (HSA) offers tax advantages while preparing for future medical expenses.

3. Take Advantage of Health Savings Accounts (HSA)

HSAs allow you to save pre-tax money for qualified medical expenses. This not only lowers taxable income but also ensures that you have a safety net for emergencies, prescriptions, and out-of-pocket expenses.

4. Consider Flexible Spending Accounts (FSA)

FSAs are another tax-saving option available through employers. These accounts let you set aside pre-tax money for medical costs, dental care, and vision expenses.

5. Use Preventive Care Benefits

Most health insurance plans cover preventive services like vaccinations, screenings, and annual check-ups at no additional cost. Using these services can help detect diseases early, reducing long-term costs.

6. Stay In-Network

Visiting out-of-network providers can significantly increase medical bills. Always confirm that doctors, hospitals, and labs are in-network before scheduling visits.

7. Negotiate Medical Bills

Few people realize that medical bills are negotiable. Many hospitals and providers are willing to reduce costs or offer payment plans if you ask. Always review bills for errors before paying.

8. Take Advantage of Employer-Sponsored Plans

If your employer offers group health insurance, it often comes at a lower cost compared to buying a plan independently. Some employers also provide wellness incentives, discounts, or premium contributions.

9. Live a Healthy Lifestyle

Insurance companies often reward healthy behavior. Maintaining a healthy weight, exercising regularly, avoiding smoking, and limiting alcohol can lead to lower premiums and fewer medical expenses in the long run.

10. Bundle Family Coverage Smartly

Sometimes, putting family members on separate policies saves money compared to a joint plan. Compare costs between family plans and individual plans before enrolling.

11. Review Your Plan Annually

Your medical needs may change from year to year. Reviewing your plan annually ensures that you are not paying for unnecessary coverage or missing out on valuable benefits.

12. Check for Government Subsidies

Many countries offer subsidies or tax credits for health insurance. For example, in the U.S., the Affordable Care Act provides credits to eligible families, lowering monthly premiums significantly.

13. Join Health Insurance Co-Ops

Some organizations and communities offer cooperative health insurance programs. These pools can offer lower premiums compared to traditional insurers.

14. Opt for Telemedicine Services

Telehealth consultations are cheaper than in-person visits and are covered by many insurers. This is an effective way to save on routine doctor visits, especially for minor illnesses.

15. Take Advantage of Wellness Programs

Insurance companies and employers often offer wellness rewards. Completing health assessments, participating in fitness programs, or quitting smoking can lead to discounts and cashback.

16. Pay Premiums Annually Instead of Monthly

Some insurers offer discounts if you pay premiums annually or semi-annually instead of monthly. This can save 5-10% over the course of a year.

17. Explore International Health Insurance (for Expats)

If you live or work abroad, international health insurance plans may offer better coverage at lower costs compared to local plans. They also cover emergency evacuation and worldwide treatment options.

18. Avoid Unnecessary Emergency Room Visits

Emergency rooms are extremely costly. Whenever possible, use urgent care centers or telemedicine for non-life-threatening issues. This small adjustment can save hundreds of dollars per visit.

19. Leverage Group Membership Discounts

Some professional organizations, alumni groups, and unions negotiate group health insurance rates for their members. Check if you are eligible for such benefits.

20. Use Generic Drugs Instead of Brand Names

Generic drugs have the same effectiveness as brand-name drugs but cost significantly less. Always ask your doctor or pharmacist for generic alternatives to reduce prescription expenses.

Final Thoughts

Health insurance doesn’t have to drain your wallet. With careful planning, smart choices, and proactive healthcare management, you can significantly cut costs while still maintaining robust coverage. Whether it’s through tax-advantaged accounts, lifestyle changes, or simply shopping around for better deals, these 20 strategies will help you save money on health insurance in 2025 and beyond.

Remember: The best health insurance is the one that balances affordability with comprehensive protection for you and your family.

Comments (3)